![]() Dollar Under Siege With U.S. Deficits Back on Wall Street's Radar

Dollar Under Siege With U.S. Deficits Back on Wall Street's Radar

By Alexandria Arnold and Katherine Greifeld

Global Growth Cycle Is Main Force of FX Market, Says Hans Redeker

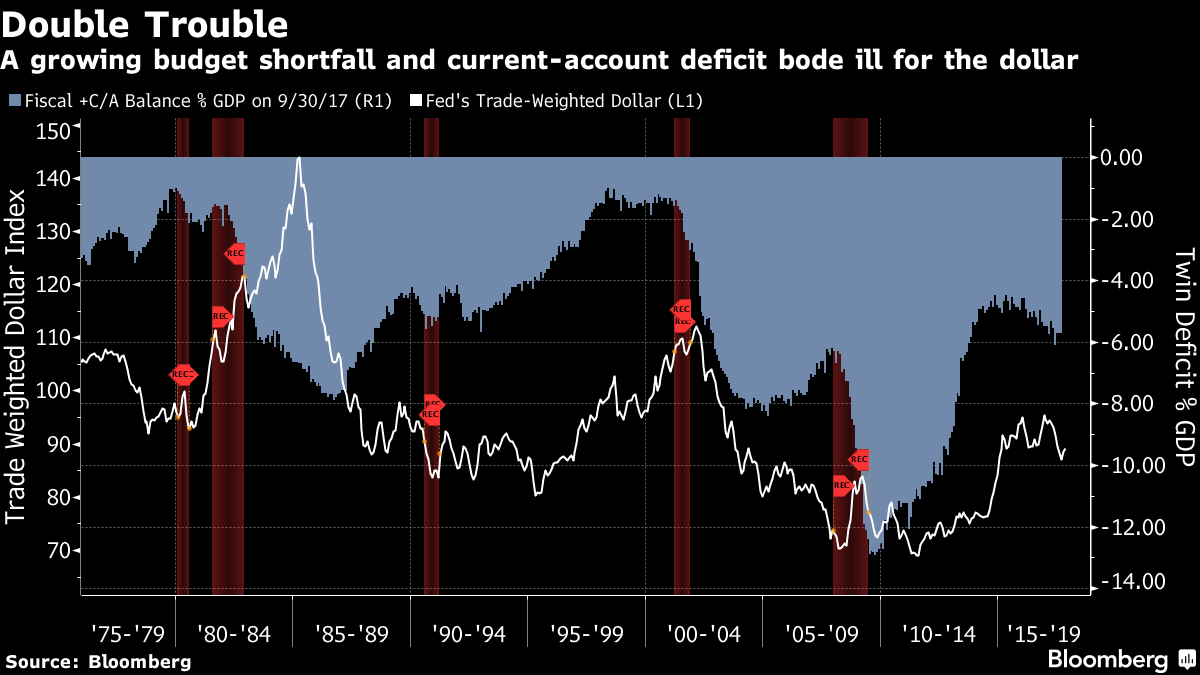

America’s fiscal largesse and the specter of wider current-account shortfalls are fueling a renewed wave of dollar bashing.

Congress’s bipartisan vote last week to increase spending by nearly $300 billion over the next two years comes on the heels of a $1.5 trillion tax cut that could boost domestic demand and the country’s trade gap. Strategists are taking heed, zeroing in on America’s twin deficits as a likely catalyst of continued greenback weakness following February’s brief respite.

Dollar bears hardly need more ammunition. Already besieged by brightening outlooks abroad and a Trump administration seemingly intending to jawbone the U.S. currency lower, the greenback is mired in a rout that’s reached 12 percent since the start of 2017. With the U.S.’s combined fiscal and current-account deficit once again approaching 6 percent of gross domestic product, the long-term outlook for the dollar is bleak, according to Mark McCormick, North American head of foreign-exchange strategy at Toronto Dominion Bank.

“When you add up the current account and the budget deficit, you’re creating a lot of external vulnerabilities for the exchange rate,” McCormick said. “We’re in an environment now where it’s becoming challenging from a capital-flows perspective to plug these.”

источник: assets.bwbx.io

источник: assets.bwbx.io

America’s budget deficit swelled in the first four months of the fiscal year, increasing 11 percent to $176 billion between October and January from the same period a year earlier, according to a Treasury Department report released Monday. That’s the largest fiscal gap since 2013, and it’s expected to keep increasing as an aging population fuels entitlement outlays while tax cuts crimp government revenue.

Data out of Washington last week showed the U.S. trade deficit excluding petroleum products widened to a record $50 billion in December as a jump in imports outpaced export gains.

Given these dynamics, McCormick estimates the dollar is still about 10 percent overvalued on a longer-term basis.

The U.S. Dollar Index has declined 3.8 percent in 2018 — its worst start to a year since 1987 — after a 9.9 percent plunge last year.

Read More: Analysts Debate What’s Behind the Dollar’s 2018 Slide

Strategists are looking for fresh drivers on which to pin the dollar’s slump amid a breakdown in the relationship with interest-rate differentials, traditionally a key force behind moves. While the two-year Treasury yield has continued its ascent this year — breaching 2 percent last month for the first time since 2008 — its 120-day correlation with the Bloomberg Dollar Spot Index has tumbled to 0.23, from an average of 0.57 in 2017. A reading of 1 would indicate the gauges move in lockstep, while minus 1 means they move in opposite directions.

источник: assets.bwbx.io

источник: assets.bwbx.io

While the U.S. typically runs a current account shortfall alongside a budget deficit, the “dynamic” of those twin deficits has shifted, according to Shahab Jalinoos, global head of FX trading strategy at Credit Suisse. Over the past few years, relatively tight fiscal policies have contained the budget gap, while booming U.S. shale production has helped narrow the current account deficit.

Now, with both pillars poised to deteriorate amid a fresh round of tax cuts and the non-energy component of the current-account shortfall widening, the twin deficits have re-emerged as a catalyst in the FX market, Jalinoos said. Against a backdrop of vibrant global growth, Credit Suisse also said it sees the dollar as overvalued and vulnerable to a drop of 10 percent in 2018.

“It’s rare for the dollar to be strong while the rest of the world is doing well,” Jalinoos said. “And I think it will be even more of a surprise for the dollar to strengthen while the U.S. is running twin deficits.”

— With assistance by Ye Xie, Benjamin Purvis, and Nicholas Reynolds

Ну уж если Китай официально озвучил поддержку доллара, то в ближайшей перспективе за доллар можно неволноваться..

Китай не доллар поддерживает, а ту систему, в которой он преуспел.

Ну какой смысл треджера обваливать, если сам на этом сотни миллиардов потеряешь?

Кризис в США вообще никому не выгоден, так как зацепит всех.

Он ее не поддерживает, а сдерживает или придерживает ради продвижения своих интересов.

Задача не в том, чтобы пустить под нож курицу, несущую золотые яйца, а в том чтобы птичка меньше ела и гадила, а яйца отдавала хозяйке в пищу и сама периодически становилась пищей.

И чтобы была курицей, а не хозяйкой, т.е. шла на прокорм той, которая ее кормит и содержит и не лезла в хозяйские дела.

Птичку и ее золотые яйца не жалко потому, что птичка — еда.